1 Gram Gold Price & Cost – Buy 1g Gold Bar in Czech Republic

A 1 gram gold bar is one of the most accessible ways to start investing in physical gold. Thanks to its low entry price, compact size, and global recognition, it has become a popular choice for first-time investors as well as those looking to build a diversified collection of precious metals.

Despite its size, it offers full exposure to gold’s market value, high liquidity, and ease of storage. For anyone interested in real assets, monitoring the 1 gram gold price is a smart way to stay informed. In the Czech Republic, you can follow the gold price per gram daily and access competitive retail rates based on the global gold price.

How Much Does 1g of Gold Cost?

The 1 gram gold cost is not a fixed figure — it changes daily and depends on several key factors. First, there’s the spot price of gold, which is the global base value per gram or ounce, determined by live trading on international markets. On top of that, retail prices include costs like refining, packaging, certification, and a small dealer markup.

For small bars like these, the cost of one gram of gold often includes a relatively higher premium per gram compared to larger bars, due to fixed handling costs. Still, the advantage of affordability outweighs the difference for most beginners. The gold price can be checked online or via trusted investment dealers, and prices are updated in real-time — so it’s worth comparing before making a purchase.

Current Gold Price per Gram in Czech Republic

The gold price in 1 gram is closely tied to the international spot price of gold, usually quoted in US dollars per ounce. In the Czech Republic, this price is converted into CZK or EUR depending on the dealer, and affected by currency exchange rates. When the dollar strengthens against the koruna, local prices typically rise — even if the global gold price remains stable.

This is why the gold rate per gram can vary not only by the day but even by the hour. Supply and demand, inflation expectations, and geopolitical tensions also play a role in gold pricing. For Czech buyers, the current cost of gold reflects both global trends and regional economic conditions, so it’s important to follow updates from reputable gold dealers who adjust their listings in real-time.

1 Gram Gold Bar – Value and Investment Benefits

Despite its small size, a 1 gram gold bar offers many advantages that appeal to a wide range of buyers. It’s often chosen as a starter investment, a gift, or part of a dollar-cost-averaging strategy to build wealth gradually. Let’s look at the key reasons to consider it:

- Low entry threshold – ideal for beginners looking to own physical gold without large upfront costs.

- High liquidity – 1g bars are easy to resell locally or internationally.

- Versatility – useful for diversifying portfolios or for gifting purposes.

- Affordable exposure – you gain access to the same precious metal as larger investors, just in smaller portions.

In terms of value of 1g, the bar reflects the same intrinsic worth as any larger format, just with a slightly higher premium. The value lies in its accessibility, and often increases over time, especially in periods of inflation or market volatility.

Fine Gold 1g – Purity and Quality

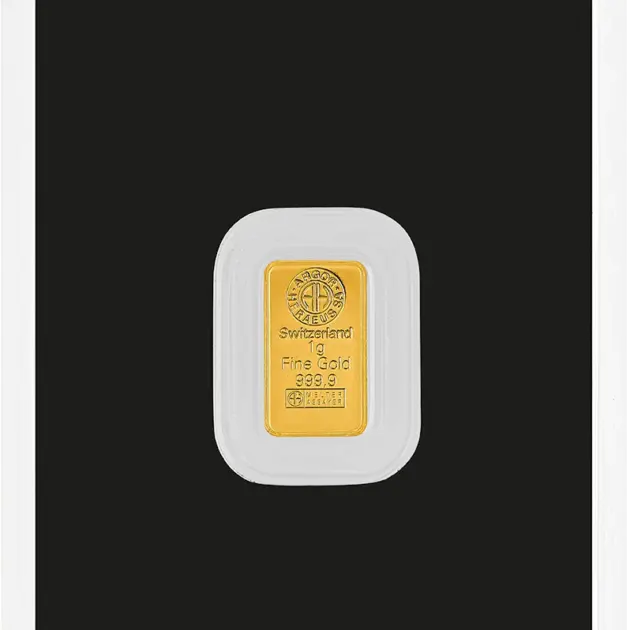

Buying a 1g means getting your hands on fine gold 1g, the purest form of gold available for private investors. With a fineness of 999.9 — that’s 99.99% purity — you’re dealing with 24-karat gold that holds its value worldwide. It’s not just about the size — it’s about the quality behind every gram.

Top-tier gold bars come from LBMA-certified refiners, such as Valcambi or Argor-Heraeus, ensuring that what you buy meets strict global standards. Each bar is sealed, numbered, and accompanied by a certificate — details that not only prove authenticity but also increase trust and resale value. That’s why the 1 gram pure gold price is tied not just to weight, but to verified quality.

So when checking the pure gold price per gram, remember: you’re not just paying for gold — you’re investing in recognized purity, proven origin, and long-term security.

Buy 1 Gram Gold Bar Safely

When you’re ready to buy 1g gold, knowing how to choose safely is just as important as the gold itself. Always make sure the bar is sealed in its original packaging, comes with a certificate, and includes a proper invoice. These aren’t just formalities — they’re your guarantee of authenticity and future resale confidence.

Look for sellers who offer insured shipping with tracking — especially if you’re purchasing online. A secure delivery ensures your investment arrives exactly as promised. The bar price should be clearly listed and confirmed before payment, especially during price fluctuations.

And don’t forget about storage. While a single buy gold 1 gram bar is easy to keep at home, many investors choose vault storage for peace of mind. Whether you’re just starting or adding to a growing portfolio, safe buying practices make all the difference.

FAQ – 1 gr Gold Price & Value

How much is 1 gram of gold worth today?

The current price per gram changes daily and reflects global market trends. Always check updated prices before making a purchase.

Is 1 gram gold a good investment?

Yes. It’s an accessible, flexible option for new investors and offers high liquidity. The value of 1g makes it easy to buy, store, and sell when needed.

What affects the gold price per gram?

Prices react to global demand, economic news, currency rates, and more. Even for small bars, the gold worth mirrors international markets.

Can I resell a 1g gold bar easily?

Definitely. Certified 1g bars are easy to resell through trusted dealers or investment platforms. Their small size and clear documentation make them ideal for fast resale.

Ready to buy a 1 gram gold bar with peace of mind? Choose certified fine gold bars with transparent pricing, proven purity, and secure delivery anywhere in the Czech Republic.

Reach out today to confirm the current gold price and take the first step toward smart gold investing.