Gold bar 10 g – investment gold for stable appreciation

Investment gold is suitable for everyone who wants to expand and diversify their portfolio with a tangible asset they can physically touch. A gold bar weighing 10 grams is perfectly suited for this purpose, as it represents a great compromise between price, liquidity, and storability.

Let’s take a closer look at investing in 10g of gold, describe its advantages, and how to carry it out safely in the Czech Republic.

Gold price 10 g – how much does 10 g of gold cost today

The price of 10 g of gold is currently (2.1.2026) around 30,000 CZK. Small differences in the prices of individual bars are mainly caused by the manufacturer, the purity, or the seller itself.

The 10 g gold price is then mostly influenced by the market price of gold on the international market, which changes daily. In addition, the current exchange rate also affects the price, as gold is traded in dollars per ounce, while the 10g price is set in Czech crowns for the Czech market.

For these reasons, individual gold bars differ, so you can choose the one that makes the most sense to you.

What is a 10g gold bar and why is it popular

A 10g gold bar represents one of the most popular weights investors look for. It is essentially a kind of “golden middle ground” that offers a balanced ratio between price, storability, and efficiency per gram of gold.

A 10g is ideal for investors who are already looking for a medium investment in gold and want to reasonably diversify their investment portfolio with a single purchase. However, if you prefer to invest in physical gold of higher value, look for higher weights, which offer a more efficient price per gram of gold. The advantage is that the 10g bar is highly liquid and can be sold anywhere in the world without problems.

Investment gold 10g – advantages of this weight

Investment gold 10g is characterized by high purity, which exceeds 99.9% – it is usually found with purities of 999.0 (99.90%) or 999.9 (99.99%), which is the purest form that can be produced.

Another advantage is the excellent storability of 10g. Since it is still a small bar, you can practically take it anywhere with you and easily store it at home. However, keep security in mind and consider investing in a durable home safe.

Finally, it should also be mentioned that 10g gold offers higher investment efficiency per gram of gold. The lower the weight, the more you pay per gram of gold. Therefore, it is more worthwhile to buy fewer larger pieces of gold bars than many smaller ones.

Gold bar 10g vs. other weights

When choosing investment gold, it is crucial to monitor the so-called spread, i.e. the difference between the purchase and buyback price. In general, the larger the bar you buy, the cheaper one gram of gold will be – logistics and minting costs are spread over a larger weight. Compared to 5g gold, the 10g gold bar is therefore a more advantageous investment.

Of course, if you are considering a more valuable purchase, then 20 g or 1 ounce (31.1 g) will probably be even more advantageous. When deciding, keep in mind that larger bars already require double or even triple the amount of capital compared to a 10g gold bar. Also consider safe storage and the available space.

How to safely buy 10g gold in the Czech Republic

When choosing to invest in gold, we recommend focusing primarily on certified gold bars that also meet the LBMA Good Delivery standard. This is a license awarded to the most prestigious refineries that produce high-quality and high-purity gold bars. Investors thus have the certainty that they can sell this investment gold anywhere in the world with high liquidity.

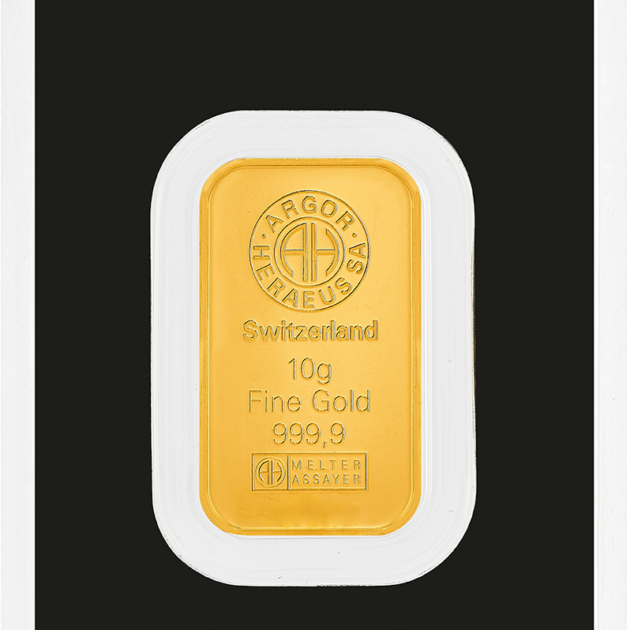

Also look for gold bars that have original packaging, the so-called blister. This packaging protects the bar, in this case 10g of gold, and also contains a certificate of authenticity – you will find it either in paper form attached to the gold bar or directly stamped on the bar itself. It contains the name of the refinery, purity, weight, and finally a unique serial number.

Finally, many manufacturers also implement security features, such as a specific holographic image located directly on the bar. Thanks to these features, you can recognize (often with an expert) that it is not a counterfeit.

If you want to buy 10g gold, also choose a verified seller. They should provide transparent prices, ideally offer a buyback guarantee, and have a proven history. An advantage is the possibility to visit a branch office, as you can see the investment gold with your own eyes and ask the staff your questions.

Frequently asked questions – 10g gold bar

How much does 10 g of gold cost today?

At today’s prices, 10 g of gold costs approximately 30,000 CZK. Its value changes based on the market price of gold on the international market, as well as the manufacturer and purity. The higher the purity, the closer the investment gold will be to its market value.

Is 10g investment gold suitable as a long-term investment?

Yes, investment gold is very suitable for long-term investment, as it allows further diversification of the portfolio and serves as a store of value in the long term. 10 grams of gold combines practicality (it is a small bar), affordability, and security.

What is the difference between a 10g and 20g gold bar?

The main difference between gold bars weighing 10 and 20 grams lies primarily in their price – at today’s price (2.1.2026), 10g investment gold costs approximately 30,000 CZK, while 20g gold costs about 60,000 CZK. With 20g gold, you can expect a lower price per gram, which makes it a more advantageous investment than lower weights.

Choose a 10g gold bar as a proven form of investment gold. Safe purchase, certified purity 999.9, and long-term value protection.