20 Gram Gold Bar – Investment Gold with High Value

Investment gold is a very popular form of investment in the Czech Republic. Many investors include it in their portfolios and believe that, in the long term, it will protect their assets and even gradually increase in value. As history shows, this strategy is certainly not a mistake.

Find out why to choose a 20 gram gold bar, how you can buy it, and what this investment will mean for your portfolio. We bring you a guide that will help you select the highest‑quality gold bars and provide information on how to make a safe purchase.

20g Gold Price – How Much Does 20 Grams of Gold Cost?

The 20 gram gold price is currently around approximately 60,000 CZK, depending on the manufacturer, purity, and also the seller from whom you purchase this investment bar. The vast majority of the price is made up of the value of gold as a commodity on the global market.

A noticeable factor affecting the 20g gold price is also the exchange rate, specifically the exchange rate of the US dollar to the Czech koruna, as gold is traded on the markets in US dollars per ounce.

What Is a 20 Gram Gold Bar

A 20 gram gold bar belongs to investment physical gold, which is exempt from VAT in the Czech Republic. When choosing it, look for the highest possible purity – ideally 999 (99.90%) or 999.9 (99.99%), which is the highest achievable purity of physical gold.

The 20 g gold bar is popular among investors who are serious about investing in physical gold and want to allocate a larger portion of capital to it. Investment gold is excellent as a diversification tool for an investment portfolio and as a safe haven for capital in uncertain periods or even during crises.

20g Investment Gold – Advantages of This Weight

Let us now look at the advantages of 20 gram gold that you may encounter as investors today and that physical gold can bring you.

- Better price-to-liquidity ratio than smaller bars: 20 gram offers one of the best investment efficiency ratios, as the price per gram is lower compared to smaller bars. This is because smaller bars have higher production and resale margins per gram.

- Easy resale: High liquidity and easy resale are further characteristics of 20g gold. If you choose high‑purity gold from a manufacturer certified by LBMA and meeting the “Good Delivery” standard, you can quickly and confidently sell it anywhere in the world.

- Suitable for medium-term and long-term investments: The 20g gold is ideal for medium‑term and long‑term investments, as gold, being a precious metal with limited supply, increases in value over time and provides investors with a safe investment that supports portfolio diversification.

20 Gram Gold Bars vs. Other Weights

A 20 gram gold bar is an excellent choice for investors who are ready to allocate a medium amount of capital. Compared to smaller bars, such as 10 grams, it comes with a lower premium, making it a more cost-effective investment. If you’re considering investing a larger amount of funds, heavier bars such as 1 ounce (31.1 g) or 50 g may offer even better value.

The 20g bar can be a “golden middle ground” for many investors. You may choose it if you plan to invest around 60,000 CZK at current prices and if its weight and size also suit your storage preferences.

However, if you aim to invest more capital, it may be more economical to buy heavier bars in smaller quantities. They generally offer better pricing than purchasing multiple smaller gold bars.

How to Buy 20g of Gold Safely in the Czech Republic

Purchasing 20g of gold safely depends on several key factors:

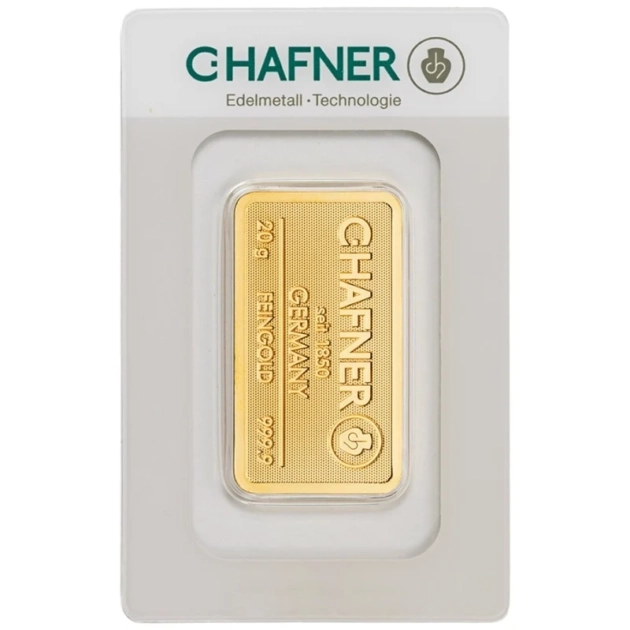

- Original Packaging (Blister Pack): Always purchase gold bars in their original sealed packaging. This guarantees authenticity and ensures the gold bar hasn’t been tampered with.

- Certificate of Authenticity: In the case of a 20 gram gold bar, the blister pack itself acts as a certificate of authenticity. Do not cut or open the packaging — doing so reduces the resale value, as the bar will be treated as scrap gold rather than an investment product.

- Certified Gold Refiners: Only buy bars from refiners certified by the London Bullion Market Association (LBMA) under the Good Delivery standard. Reputable LBMA-certified refiners include Argor-Heraeus, PAMP, Valcambi (all Switzerland), and C.Hafner (Germany).

- Trusted Dealer: A safe gold purchase also depends on a trustworthy seller. Look for dealers who offer store visits, buy-back guarantees, fixed pricing, and transparent stock listings — where you can see exactly what is available for immediate purchase and what needs to be ordered.

Frequently Asked Questions – 20 Gram Gold Bar

How much does a 20g gold bar cost today?

Currently, a 20g gold bar costs approximately 60,000 CZK, but the price varies depending on the refiner, purity, and the specific dealer. The main factor influencing the value is the global gold price as a precious metal on international markets.

Is 20g investment gold suitable for beginners?

Yes, 20 gram gold is a solid entry point for beginners. It does not require professional or bank-grade storage, as is the case with large, high-value bars. A 20g is compact and easy to store at home — just ensure proper security measures are in place.

What is the difference between a 20g and a 10g gold bar?

Besides the weight, the key difference lies in the premium per gram. The higher the weight of the bar, the lower the premium you pay per gram. That’s why a 20 gram gold bar is generally a better investment than buying 2 bars of 10g or 4 bars of 5g.

Choose a 20 gram gold bar as a reliable form of investment gold. Certified 999.9 purity and a secure purchase ensure long-term protection of your assets.