1 Ounce Gold Price & Value – Buy a 1 oz Gold Bar in Czech Republic

The 1 ounce, weighing 31.1 grams, is considered the global benchmark of investment gold. This format is used worldwide for pricing, trading, and long-term storage of physical gold, which is why most international markets quote the price per ounce of gold as a standard reference.

Thanks to its balance between size, liquidity, and recognition, 1 oz gold is widely accepted by dealers, banks, and investors across different countries.

The gold price per ounce is calculated based on the international spot market and adjusted by a dealer premium that covers refining, certification, secure packaging, and distribution. This makes the one-ounce bar a clear, transparent, and globally comparable investment option, suitable for both experienced investors and those building a serious long-term portfolio.

How Much Does 1 Ounce of Gold Cost?

To understand how much does 1 ounce of gold cost, it is important to start with the spot price. The spot price represents the real-time value of gold traded on global exchanges and is quoted per troy ounce.

The final retail price of a physical gold bar is slightly higher. This difference reflects the dealer premium, which includes the cost of refining, branding, certified packaging, logistics, and secure delivery. Well-known refineries usually carry a more stable premium due to their strong global reputation.

In addition, the cost of an ounce of gold is influenced by currency movements and global economic conditions. Changes in USD, EUR, or CZK exchange rates can affect local pricing, which explains why the price may vary from day to day even if market conditions appear calm.

Current Gold Price per Ounce in Czech Republic

In the Czech Republic, the gold price per ounce is derived from international markets, primarily from the XAU/USD rate, which is then converted into Czech crowns. This means the local price reflects both global gold movements and current currency exchange rates.

A major advantage for investors is that investment gold in the Czech Republic is VAT-free. This allows buyers to purchase physical gold without additional tax costs, preserving more of the metal’s intrinsic value.

The final price of the ounce of gold typically reflects several combined factors:

- international spot market movements,

- CZK exchange rate fluctuations,

- refinery brand and packaging standards,

- dealer margin and logistics costs.

Despite daily fluctuations, the gold ounce price remains relatively stable compared to many financial assets, which is why the 1 oz format continues to be one of the most trusted investment weights in Europe.

Value of One Ounce of Gold

The value of gold is not based on promises or financial performance, but on its physical scarcity and universal acceptance. This intrinsic nature is what gives gold long-term credibility as a store of wealth.

Historically, one ounce of gold has maintained purchasing power during periods of inflation, currency devaluation, and economic uncertainty. For this reason, many investors view gold as a strategic hedge rather than a speculative asset.

From a practical perspective, the gold cost an ounce is easy to track, transparent, and globally standardized. Because gold is traded internationally per ounce, the 1 ounce format offers unmatched liquidity, making resale simple almost anywhere in the world.

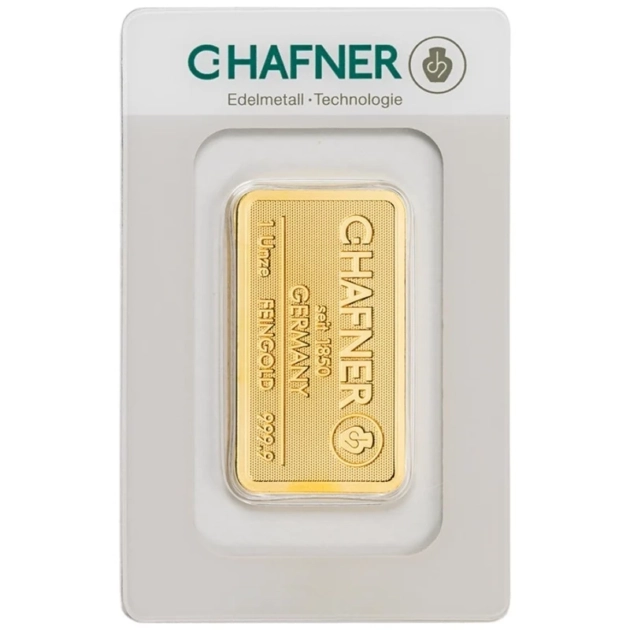

1 oz Gold Bar – Weight, Purity & Certification

If you’re looking for one of the most trusted gold formats in the world, the 1 oz gold bar is hard to beat. With a precise weight of 31.1 grams, this format has become the global standard for individual investors and institutions alike.

A 1 ounce gold bar typically features a gold purity of 999.9, also known as 24-karat gold. This represents the highest investment-grade quality available and ensures your gold is free from any significant impurities. Purity like this isn’t just a number — it’s a mark of global trust.

To guarantee authenticity and ease of resale, these bars are produced by LBMA-accredited refiners. Some of the most reputable include:

- Valcambi, PAMP, and Argor-Heraeus (Switzerland)

- Serial-numbered bars sealed in tamper-evident packaging

- Certificate of authenticity included (often built into the packaging)

- Guaranteed international acceptance under the Good Delivery standard

Whether you’re storing your gold at home or in a secure facility, a gold bar ounce offers a reliable, standardized, and secure investment.

Is a 1 Ounce Gold Bar a Good Investment?

The one ounce gold format is widely considered a sweet spot for private investors. It’s large enough to hold significant value, yet small enough to remain flexible — a balance that’s not always easy to achieve with other weights.

Compared to 20g bars, the 1 oz gold bar often comes with a lower price per gram, thanks to reduced production costs and tighter spreads. On the other hand, while heavier bars like 50g or 100g may offer even better value, they lack the global liquidity and ease of resale that one-ounce bars provide.

Here’s why ounce gold is a smart choice:

- Strong global recognition and resale potential

- Compact and easy to store or transport

- Ideal for medium-sized investments without overcommitting

- Popular among both first-time and seasoned investors

FAQ – Gold Price per Ounce

How much does an ounce of gold cost today?

It depends on the current spot price plus the dealer’s margin for certification and delivery.

What affects the gold price per ounce?

Factors include supply and demand, inflation, interest rates, and global market conditions.

Is a 1 oz gold bar easy to resell?

Yes. It’s one of the most widely recognized and liquid gold formats on the global market.

Why is gold priced per ounce?

The troy ounce is the traditional and standardized unit used across all major bullion markets.

Looking to invest in a 1 ounce (31.1 g) gold bar in the Czech Republic? We offer LBMA-certified gold bars with verified purity, transparent pricing, and secure delivery.

Contact us today to get the latest gold price and make your purchase with full confidence.