50 Gram Gold Price & Value – Buy a 50g Gold Bar in Czech Republic

Looking for the right balance between investment value and flexibility? A 50g of gold bar might be the sweet spot you’re after. It offers more weight and value than smaller bars like 5g or 10g, yet stays affordable and easy to store compared to heavier pieces like 100g.

The 50 gram gold price is calculated by multiplying the current market (spot) price of gold per gram by 50. But that’s not all — the final retail cost also includes a dealer premium, which varies depending on the brand, packaging, and availability.

How Much Does 50 Grams of Gold Cost?

To estimate the cost of 50 grams of gold, you need to understand how its price is formed. At the core is the spot price of gold, typically quoted in USD per troy ounce. Since there are roughly 31.1 grams in an ounce, a simple calculation will give you the per-gram value — which you then multiply by 50.

However, the final 50 grams of gold cost you pay will likely be higher than this raw number. Why? Because every seller adds a premium — an amount that covers manufacturing, certification, distribution, and their margin. Premiums may vary depending on whether you’re buying a global brand (like PAMP or Valcambi) or a locally minted bar. Additionally, currency exchange rates (USD/CZK) and international gold market shifts can influence the final price on any given day.

Current 50g Gold Price in Czech Republic

In the Czech Republic, the bar price you see in stores or online usually differs slightly from the global spot price — and that’s normal. The retail gold 50 gram price includes the seller’s margin and may vary depending on the brand and packaging of the bar. Still, the overall pricing remains transparent and follows the international market closely.

One key advantage: physical gold with a purity of 999.9 (such as fine gold 50g bars) is classified as investment gold — meaning it’s VAT-free. That’s a major benefit for buyers in the Czech Republic. Keep in mind that gold prices are updated daily, often multiple times, depending on how actively the global market moves. The final gold price you see will typically be locked in at the moment of your purchase.

Value of a 50 Gram Gold Bar

Why do investors trust gold as a long-term store of value? Because it’s stood the test of time. A 50g gold bar is large enough to represent significant value, yet small enough to stay flexible when you need liquidity. Whether you’re building a personal reserve, hedging against inflation, or diversifying your portfolio, it offers real financial stability.

The bar worth today depends on the market, but its value doesn’t stop at numbers. This bar holds intrinsic worth: it’s portable, globally recognized, and easy to sell when needed. In terms of portfolio strategy, a 50 gram gold value investment adds weight to your long-term goals while remaining practical — especially compared to both very small or very large bars.

Key advantages of a 50 gram include:

- Long-term value preservation – gold maintains purchasing power over decades.

- Inflation protection – physical gold serves as a hedge against currency devaluation.

- High liquidity – 50g is a globally tradable format, accepted by most dealers and investors.

- Portfolio diversification – adding gold reduces exposure to volatile financial assets.

- Tangible security – you own a real, physical asset independent of the banking system.

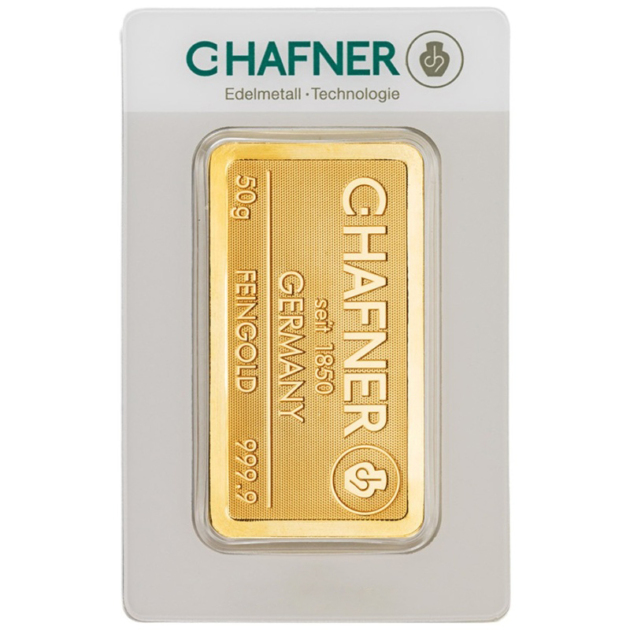

50g Gold Bar – Purity, Form & Certification

When investing in physical gold, purity and authenticity are everything. A 50 gram gold bar typically meets the highest global standard of 999.9 fine gold, also known as 24 karat. This ensures that you’re getting pure investment-grade metal with no compromises.

Top brands such as Valcambi, PAMP Suisse, and Argor-Heraeus manufacture their 50g gold bar products under strict quality control, following the LBMA Good Delivery standards. These bars come sealed in tamper-proof blister packs, complete with a unique serial number and certificate of authenticity.

What does this mean for you as an investor? A bar produced by a LBMA-accredited refinery is easier to verify, easier to resell, and holds higher trust among gold dealers worldwide. It’s not just gold — it’s recognized gold.

Is a 50 Gram Gold Bar a Good Investment?

The 50g gold value sits right in the sweet spot between convenience and efficiency. It offers a lower cost per gram compared to smaller bars, yet doesn’t require the capital commitment of heavier formats. This makes it an ideal option for investors with a mid-range budget who want to own real, physical gold.

A 50 gram gold bar combines flexibility and financial sense. Here’s why it may be the right choice for you:

- Better value per gram than 5g, 10g, or 20g bars

- Easier to resell than larger 100g or 250g bars

- Popular size — widely accepted and recognized by dealers

- Easy to store and transport

- Balanced entry point for serious physical gold investors

Whether you’re making your first investment or adding weight to an existing portfolio, 50g delivers on both liquidity and cost efficiency.

FAQ – 50 Gram Gold Price & Value

How much is 50g of gold worth today?

The value of gold depends on the current spot price and dealer premium; it’s updated daily.

What affects the 50g gold price?

The gold 50 gram price is influenced by global gold markets, currency exchange rates, and dealer-specific costs.

Is a 50 gram gold bar easy to resell?

Yes. A branded, certified gold bar is highly liquid and accepted by most gold dealers globally.

Is a 50g gold bar better than smaller gold bars?

In most cases, yes — it offers better pricing per gram and remains easy to trade, making it a smart step up from entry-level bars.

Looking to buy a 50 gram gold bar in the Czech Republic? We offer certified fine gold with transparent pricing, verified purity, and secure delivery.

Contact us today to check the current gold bar price and place your order.